There are several schools of thought when it comes to dividend investing.

The two most common are Dividend Growth and High Yield. Investors who are at the stage of their life where they need their portfolios to produce a certain income stream often focus on the areas of the market that offers the highest yield. These portfolios often have a heavy allocation to Canadian Banks, pipelines, utilities and real estate. One thing that these stocks have in common are that they are very sensitive to fluctuations in interest rates.

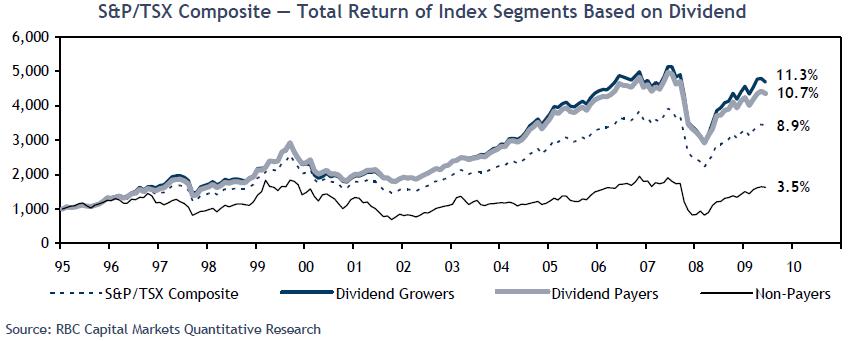

Investors who are trying to build their wealth by contrast pursue a Dividend Growth strategy. These investors aren’t deterred by the initial yield on their investments. Instead they hunt for companies that can consistently raise their dividends every year at a rate in excess of inflation. The best ones can deliver double digit dividend increases annually. Over time this strategy has been proven to outperform the TSX. Think about it. In order to produce large dividend increases a company must possess the following characteristics: growing earnings, a robust economic moat (competitive advantage) and a shareholder friendly management team. Another benefit is that these companies often have low dividend payout ratios which makes them less vulnerable to a dividend cut.

Some of the best Dividend Growth stocks include CN Rail, Toromont Industries, Waste Connections and Visa.

The goal is to build a diversified portfolio that produces a rising income stream over time. By focusing on the income side of the equation, investors can ignore the ups and downs of the stock market. It’s the cash flow that matters.

Investing doesn’t have to be complicated. Focus on the cash flow. Think Dividends.